Relativity’s last public financing announcement came in 2021 with a Series E raise of $650 million. At the time, the company had about 400 employees, but it ended the first half of this year with 1,225 employees, according to the investor letter this summer.

Since then, the company has conducted a much less publicized Series F raise. Notably, the value of the shares sold during the latest raise was $22.67, slightly less than the Series E round, which valued shares at $22.84. This slightly reduced valuation of the company’s shares comes at a capital-intensive time for Relativity as it seeks to push the Terran R rocket across the finish line. For example, the company’s workforce has increased by about 20 percent in the last year as it scales to meet the demands of Terran R.

I asked Ellis about the funding Relativity must raise to launch Terran R. The company’s timeline suggests that a launch could happen in two years, but in aerospace, almost every major project is significantly delayed. So the company might need to keep raising significant capital into the late 2020s before Terran R becomes operational.

“It’s obviously something we think about,” Ellis said. “It’s not the number one thing keeping me up at night right now, given we have not just great investors but also great customers. I can’t comment on whether we’re currently in a fundraising round. But what I can say is, of course, building a large rocket is expensive. I think, actually, investors are most scared of funding something that works, and then nobody wants it. There is no way to fail slower and more expensively than to give a company all the money and then nobody wants it.”

There is real demand, and Relativity is realizing revenue from its contracts. Typically, within the industry, about 10 percent is paid upfront and then additional revenue comes in as various milestones are met. But it will take a lot of money to get Terran R to the launch pad. This places a lot of pressure on Ellis and his team. A few years ago, Relativity was printing rockets and printing money. Now, they’re taking a more traditional path in a more challenging fundraising environment for new space companies.

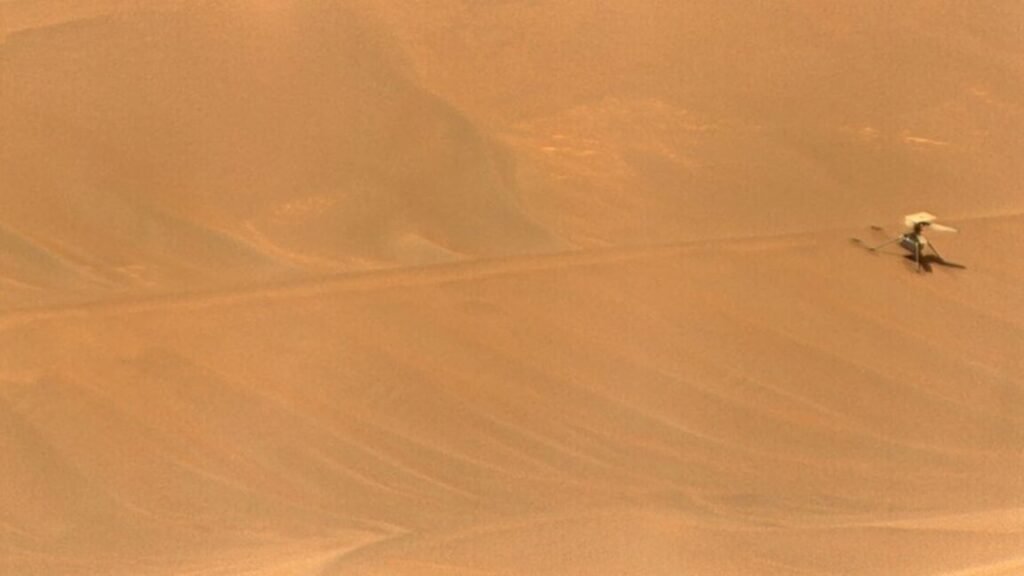

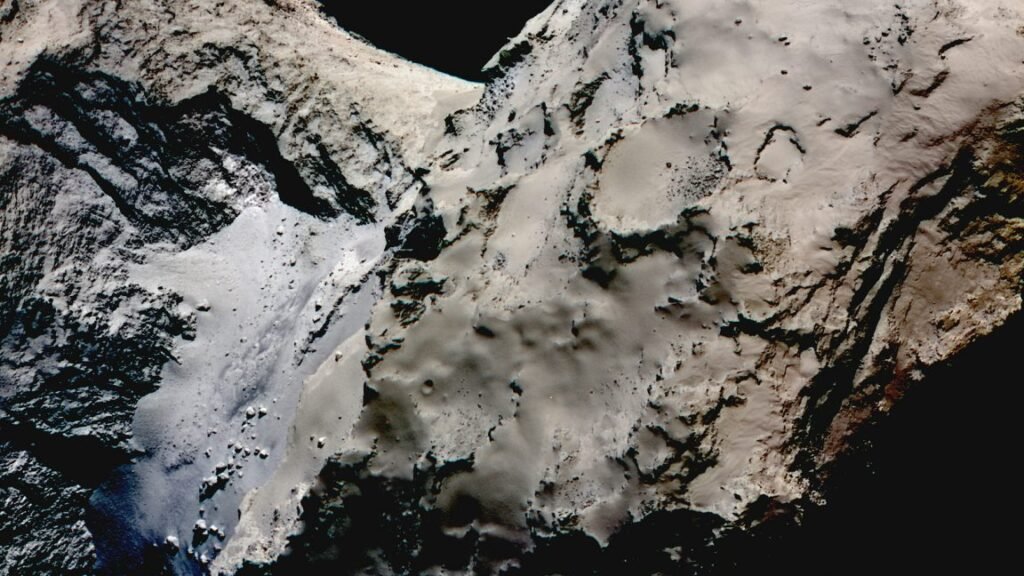

Space is hard. Rocket startups are harder.